How Does A Bank Service Charge Appears On A Reconciliation As A(N)

Fraud, Internal Controls, and Greenbacks

49 Define the Purpose of a Bank Reconciliation, and Fix a Bank Reconciliation and Its Associated Periodical Entries

The banking concern is a very of import partner to all businesses. Non just does the bank provide basic checking services, merely they procedure credit carte transactions, keep cash safe, and may finance loans when needed.

Bank accounts for businesses tin involve thousands of transactions per month. Due to the number of ongoing transactions, an organisation'due south book residuum for its checking business relationship rarely is the aforementioned every bit the residual that the bank records reflect for the entity at any given signal. These timing differences are typically caused by the fact that there will exist some transactions that the organization is enlightened of before the banking company, or transactions the banking concern is aware of before the company.

For instance, if a company writes a check that has not cleared yet, the company would be aware of the transaction before the bank is. Similarly, the depository financial institution might have received funds on the company's behalf and recorded them in the banking concern'south records for the company earlier the organization is aware of the eolith.

With the big volume of transactions that impact a banking concern account, it becomes necessary to have an internal control system in place to clinch that all cash transactions are properly recorded within the bank account, likewise equally on the ledger of the business organization. The bank reconciliation is the internal financial study that explains and documents any differences that may exist betwixt the rest of a checking account as reflected by the bank's records (bank residual) for a company and the company'due south accounting records (company rest).

The bank reconciliation is an internal certificate prepared by the company that owns the checking account. The transactions with timing differences are used to adjust and reconcile both the bank and company balances; afterward the banking company reconciliation is prepared accurately, both the depository financial institution balance and the visitor residual will be the same amount.

Annotation that the transactions the visitor is enlightened of have already been recorded (journalized) in its records. However, the transactions that the banking company is aware of but the company is not must be journalized in the entity's records.

Fundamentals of the Banking concern Reconciliation Procedure

The remainder on a banking company statement can differ from company's financial records due to one or more than of the following circumstances:

- An outstanding check: a check that was written and deducted from the financial records of the company but has not been cashed by the recipient, so the amount has not been removed from the bank account.

- A deposit in transit: a deposit that was made past the business and recorded on its books but has non yet been recorded by the depository financial institution.

- Deductions for a depository financial institution service fee: fees oft charged by banks each month for management of the bank business relationship. These may be fixed maintenance fees, per-check fees, or a fee for a check that was written for an amount greater than the balance in the checking account, called an nonsufficient funds (NSF) check. These fees are deducted past the bank from the account but would not appear on the fiscal records.

- Errors initiated by either the client or the bank: for example, the customer might tape a check incorrectly in its records, for either a greater or lesser corporeality than was written. Also, the depository financial institution might written report a bank check either with an wrong balance or in the wrong client'due south checking account.

- Additions such as interest or funds collected by the depository financial institution for the client: interest is added to the depository financial institution account equally earned but is not reported on the financial records. These additions might besides include funds nerveless by the banking company for the client.

Demonstration of a Bank Reconciliation

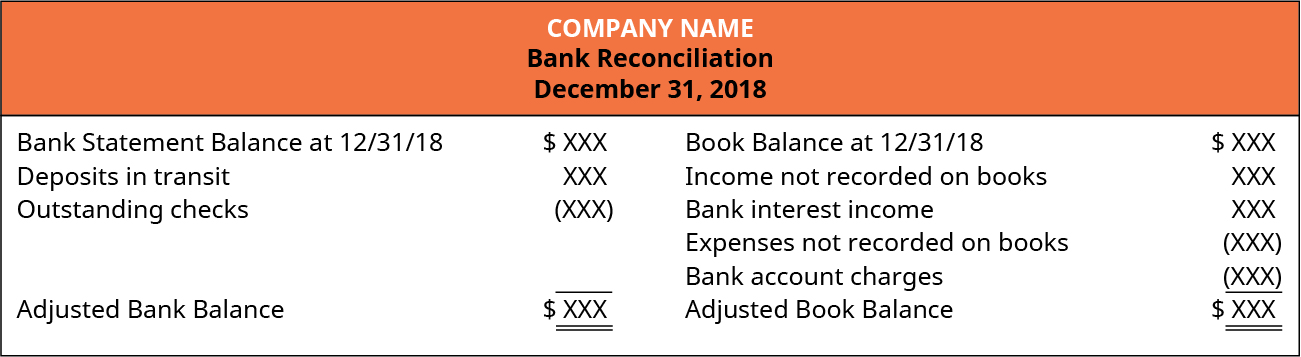

A bank reconciliation is structured to include the information shown in (Figure).

Bank Reconciliation. A bank reconciliation includes categories for adjustments to both the bank rest and the volume balance. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA iv.0 license)

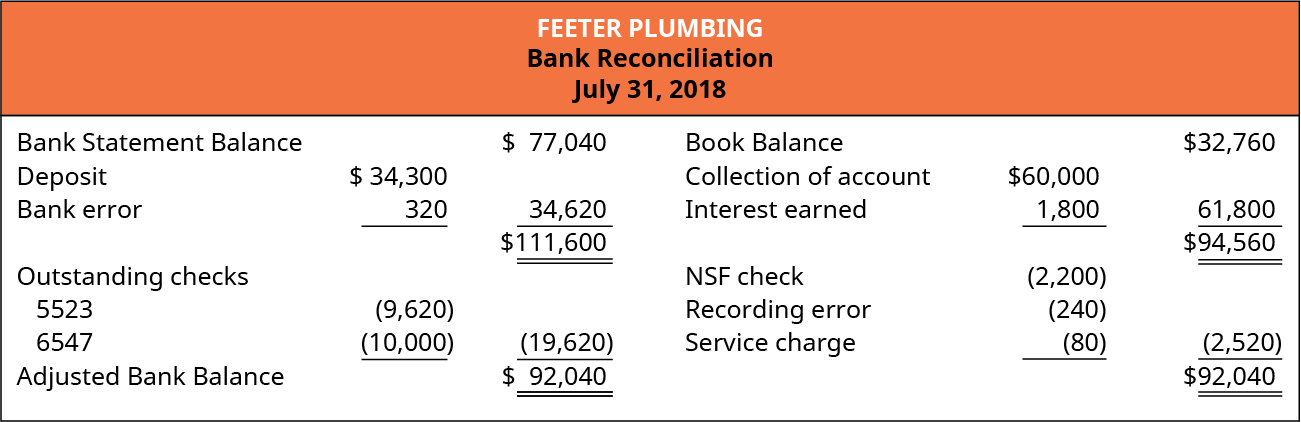

Assume the post-obit circumstances for Feeter Plumbing Company, a pocket-sized business located in Northern Ohio.

- After all posting is up to appointment, at the end of July 31, the book balance shows $32,760, and the depository financial institution statement balance shows $77,040.

- Cheque 5523 for $9,620 and 6547 for $10,000 are outstanding.

- Check 5386 for $2,000 is removed from the depository financial institution account correctly simply is recorded on the accounting records for $i,760. This was in payment of dues. The effects of this transaction resulted in an error of $320 that must be deducted from the visitor's book balance.

- The July 31 night deposit of $34,300 was delivered to the bank later hours. As a upshot, the deposit is not on the bank statement, but information technology is on the financial records.

- Upon review of the bank statement, an error is uncovered. A check is removed from the account from Feeter for $240 that should have been removed from the account of another customer of the bank.

- In the bank statement is a annotation stating that the banking concern nerveless $60,000 in charges (payments) from the credit card company likewise as $1,800 in interest. This transaction is on the banking concern argument but not in the company'south financial records.

- The bank notified Feeter that a $two,200 bank check was returned unpaid from customer Berson due to insufficient funds in Berson's account. This check render is reflected on the banking concern argument but not in the records of Feeter.

- Bank service charges for the month are $80. They have non been recorded on Feeter'south records.

Each item would be recorded on the bank reconciliation every bit follows:

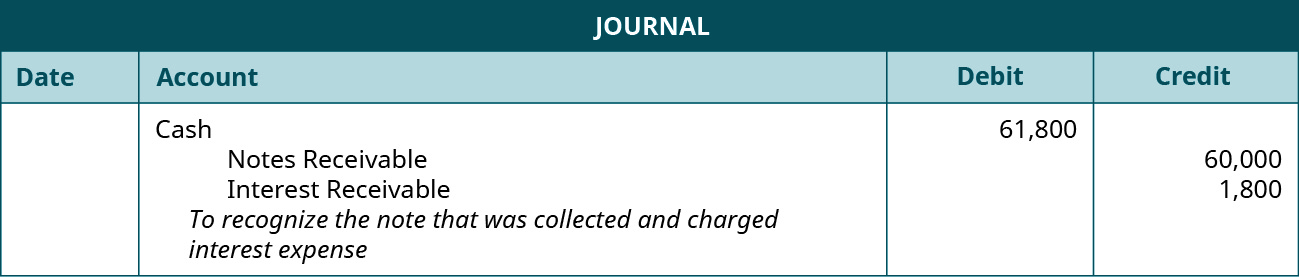

One important trait of the bank reconciliation is that it identifies transactions that have not been recorded by the company that are supposed to be recorded. Journal entries are required to accommodate the book residue to the correct residual.

In the case of Feeter, the first entry will record the collection of the note, besides as the interest collected.

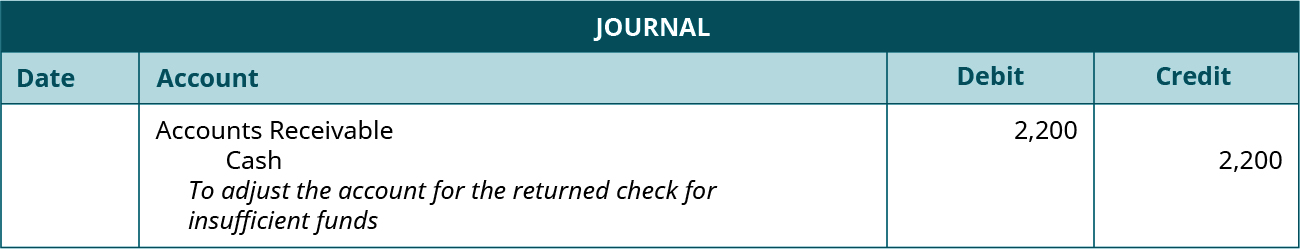

The second entry required is to arrange the books for the check that was returned from Berson.

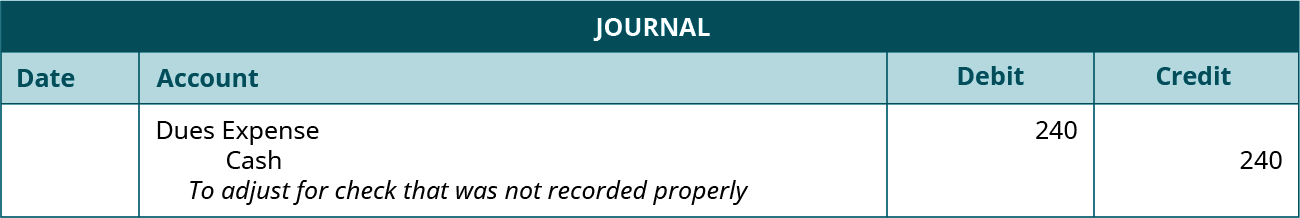

The third entry is to adjust the recording mistake for check 5386.

The final entry is to record the depository financial institution service charges that are deducted by the bank but have not been recorded on the records.

The previous entries are standard to ensure that the bank records are matching to the financial records. These entries are necessary to update Feeter‛s general ledger cash account to reflect the adjustments made by the banking concern.

Cardinal Concepts and Summary

- The banking concern reconciliation is an internal document that verifies the accuracy of records maintained by the depositor and the financial institution. The balance on the banking concern statement is adapted for outstanding checks and uncleared deposits. The record balance is adapted for service charges and interest earned.

- The depository financial institution reconciliation is an internal control certificate that ensures transactions to the bank account are properly recorded, and allows for verification of transactions.

(Figure)Which of the following items are found on a volume side of the banking company reconciliation?

- showtime bank remainder

- outstanding checks

- involvement income

- error made by banking company

(Figure)Which of the post-obit are constitute on the banking company side of the bank reconciliation?

- NSF check

- interest income

- wire transfer into client'south account

- deposit in transit

(Effigy)What is the purpose of the banking concern reconciliation?

(Figure)What should be done if differences are found between the banking concern argument and the volume account?

All differences must be researched, explained, and corrected. Differences pertaining to the bank must be reported. If fraud is suspected, a complete investigation must exist performed.

(Figure)The bank reconciliation shows the following adjustments:

- Deposits in transit: $ane,234

- Outstanding checks: $558

- Banking concern service charges: $50

- NSF checks: $250

Prepare the correcting journal entry.

(Figure)The bank reconciliation shows the post-obit adjustments:

- Deposits in transit: $852

- Notes receivable collected by banking concern: $1,000; interest: $20

- Outstanding checks: $569

- Mistake by banking concern: $300

- Bank charges: $30

Set the correcting journal entry.

(Figure)Using the following data, ready a depository financial institution reconciliation.

- Bank balance: $3,678

- Book residual: $2,547

- Deposits in transit: $321

- Outstanding checks: $108 and $334

- Bank charges: $25

- Notes receivable: $one,000; interest: $35

(Figure)Set the journal entry to reconcile the bank statement in (Figure).

(Figure)Using the following information, set up a bank reconciliation.

- Bank residual: $4,587

- Book balance: $5,577

- Deposits in transit: $one,546

- Outstanding checks: $956

- Interest income: $56

- NSF check: $456

(Effigy)Ready the journal entry to reconcile the banking company argument in (Effigy).

(Effigy)Using the post-obit information, set a bank reconciliation.

- Depository financial institution balance: $six,988

- Book balance: $6,626

- Deposits in transit: $1,600

- Outstanding checks: $599 and $1,423

- Bank charges: $75

- Banking concern incorrectly charged the account $75. The bank will correct the error adjacent month.

- Check number 2456 correctly cleared the bank in the amount of $234 but posted in the accounting records as $324. This check was expensed to Utilities Expense.

(Figure)Set up the journal entry to reconcile the banking company statement in (Figure).

(Effigy)The banking concern reconciliation shows the following adjustments.

- Deposits in transit: $526

- Outstanding checks: $328

- Depository financial institution charges: $55

- NSF checks: $69

Prepare the correcting periodical entry.

(Figure)The bank reconciliation shows the following adjustments.

- Deposits in transit: $1,698

- Notes receivable nerveless by bank: $ii,500; interest: $145

- Outstanding checks: $987

- Error by bank: $436

- Banking concern charges: $70

Set up the correcting periodical entry.

(Effigy)Using the following information, prepare a bank reconciliation.

- Banking concern balance: $iv,021

- Book remainder: $2,928

- Deposits in transit: $1,111

- Outstanding checks: $679

- Bank charges: $35

- Notes receivable: $i,325; interest: $235

(Figure)Ready the journal entry to reconcile the bank statement in (Figure).

(Figure)Using the following information, set up a depository financial institution reconciliation.

- Banking concern balance: $vii,651

- Book residue: $10,595

- Deposits in transit: $2,588

- Outstanding checks: $489

- Interest income: $121

- NSF check: $966

(Figure)Prepare the journal entry to reconcile the banking concern statement in (Figure).

(Figure)Using the following information, prepare a depository financial institution reconciliation.

- Bank balance: $12,565.

- Volume balance: $13,744.

- Deposits in transit: $2,509.

- Outstanding checks: $one,777.

- Bank charges: $125.

- Bank incorrectly charged the account for $412. The banking concern volition correct the fault next month.

- Check number 1879 correctly cleared the bank in the amount of $562 but posted in the accounting records every bit $652. This bank check was expensed to Utilities Expense.

(Figure)Prepare the periodical entry to reconcile the banking company argument in (Figure).

(Figure)Place where each of the following transactions would be constitute on the depository financial institution reconciliation.

| Transaction | Increase to Bank Side | Decrease to Bank Side | Increase to Book Side | Decrease to Book Side |

|---|---|---|---|---|

| Outstanding cheque | ||||

| Interest income | ||||

| NFS check | ||||

| Wire transfer by customer | ||||

| Deposit in transit | ||||

| Depository financial institution charges | ||||

(Figure)Which of the following transactions volition require a journal entry? Indicate if it volition be a debit or a credit and to what account the entry will be recorded.

| Transaction | No Journal Entry Needed | Journal Entry Needed | Debit | Credit |

|---|---|---|---|---|

| Outstanding check | ||||

| Involvement income | ||||

| NFS check | ||||

| Wire transfer by customer | ||||

| Deposit in transit | ||||

| Bank charges | ||||

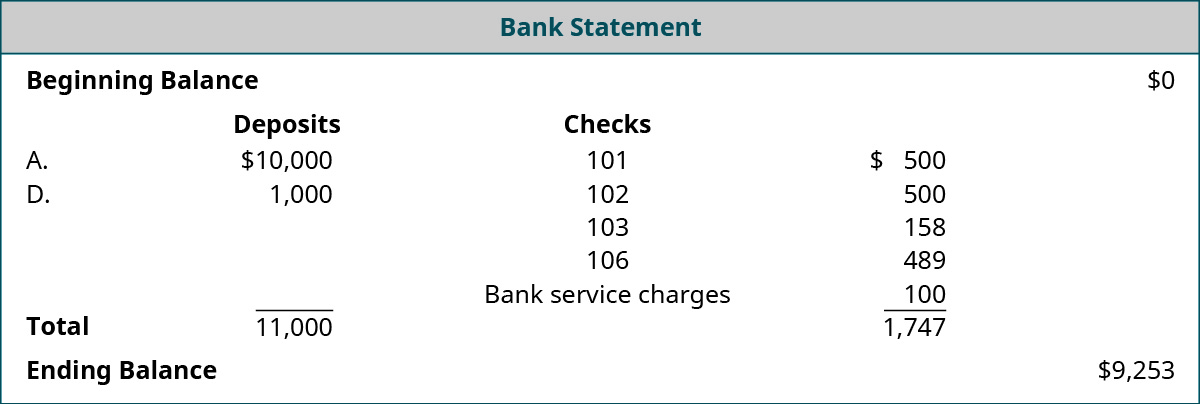

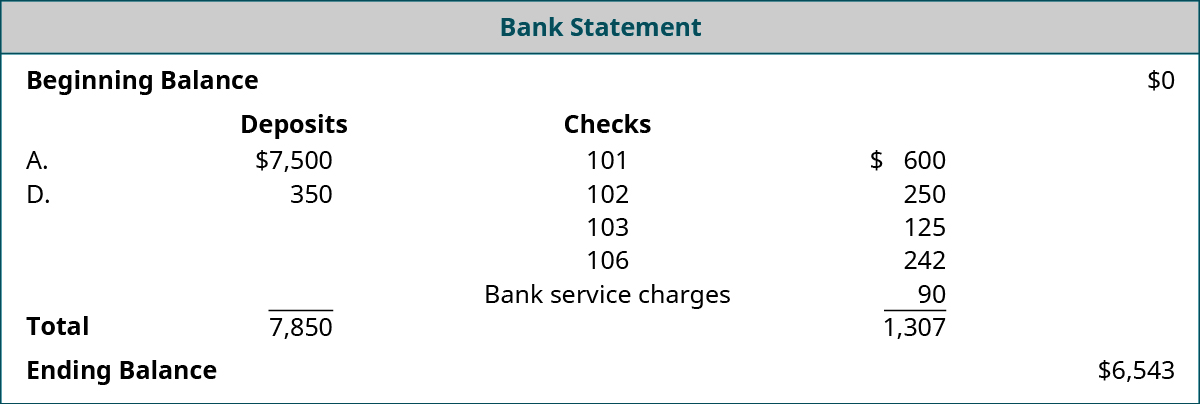

(Figure)Domingo Visitor received the post-obit banking concern argument. Using (Figure), prepare the bank reconciliation.

(Figure)Prepare the periodical entry required to reconcile the volume balance to the bank balance.

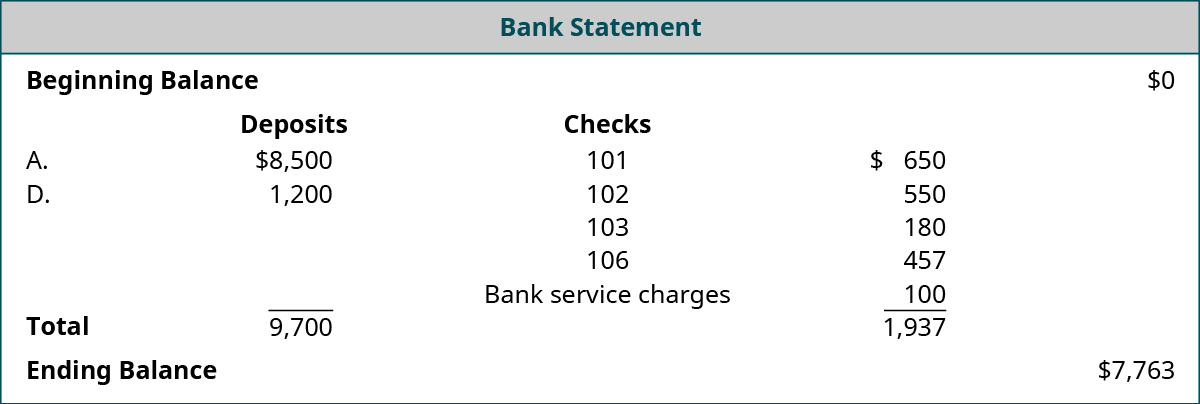

(Figure)Inner Resource Company received the following banking concern statement. Using the data from (Effigy) and (Figure), set up the bank reconciliation.

(Figure)Prepare the journal entry required to reconcile the volume balance to the bank balance.

(Figure)Identify where each of the following transactions would exist establish on the bank reconciliation.

| Transaction | Increase to Bank Side | Decrease to Bank Side | Increase to Book Side | Decrease to Volume Side |

|---|---|---|---|---|

| Overcharge by Depository financial institution (Error) | ||||

| Involvement Income | ||||

| Automatic Loan Payment | ||||

| Wire Transfer past Customer | ||||

| Deposit in Transit | ||||

| Outstanding Check | ||||

(Figure)Which of the following transactions will require a journal entry? Indicate if it volition be a debit or a credit, and to which account the entry will be recorded.

| Transaction | No Journal Entry | Journal Entry Needed | Debit | Credit |

|---|---|---|---|---|

| Overcharge past Bank (Error) | ||||

| Involvement Income | ||||

| Automatic Loan Payment | ||||

| Wire Transfer by Customer | ||||

| Deposit in Transit | ||||

| Outstanding Check | ||||

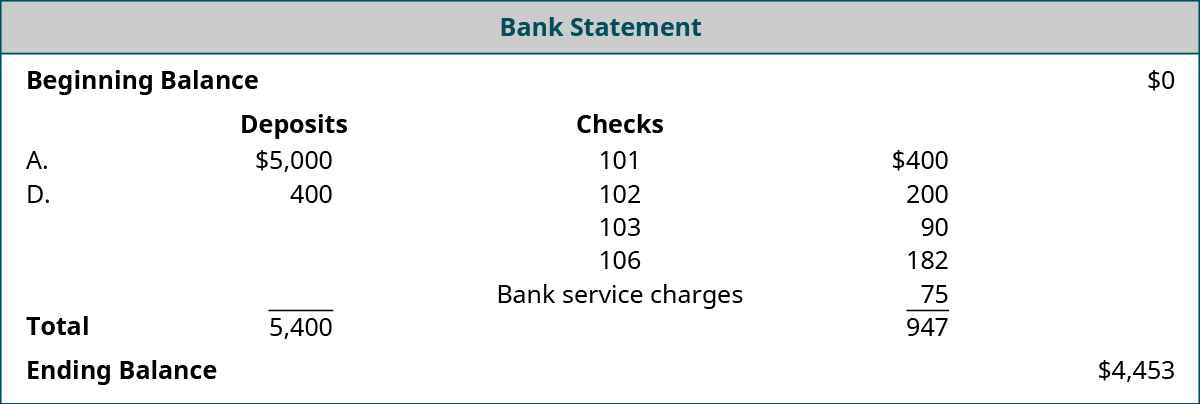

(Effigy)Hajun Company received the following bank argument. Using the information from (Effigy) and (Figure), prepare the bank reconciliation.

(Figure)Prepare the journal entry required to reconcile the volume balance to the depository financial institution balance.

(Effigy)Lavender Visitor received the following bank statement. Using the information from (Figure) and (Figure), gear up the banking company reconciliation.

(Figure)Ready the journal entry required to reconcile the book balance to the banking concern balance.

(Figure)A bank reconciliation takes fourth dimension and must residue. An employee was struggling in balancing the banking concern reconciliation. Her supervisor told her to "plug" (make an unsupported entry for) the difference, record to Miscellaneous Expense, and simply motion on. Discuss the internal controls problem with this directive.

(Effigy)The bank reconciliation revealed that ane eolith had cleared the banking company 2 weeks after the date of the eolith. Should this exist of concern? Why, or why not?

Glossary

- banking concern reconciliation

- internal financial report that explains and documents any differences that may exist between a rest within a checking account and the company's records

- bank service fee

- fee ofttimes charged by a bank each calendar month for management of the bank account

- deposit in transit

- deposit that was made by the business organization and recorded on its books but has not yet been recorded past the bank

- nonsufficient funds (NSF) check

- check written for an amount that is greater than the residual in the checking account

- outstanding check

- bank check that was written and deducted from the fiscal records of the company just has not been cashed by the recipient, so the amount has not been removed from the bank account

How Does A Bank Service Charge Appears On A Reconciliation As A(N),

Source: https://opentextbc.ca/principlesofaccountingv1openstax/chapter/define-the-purpose-of-a-bank-reconciliation-and-prepare-a-bank-reconciliation-and-its-associated-journal-entries/

Posted by: morriscouttepore1968.blogspot.com

0 Response to "How Does A Bank Service Charge Appears On A Reconciliation As A(N)"

Post a Comment